On October 22nd, IXIASOFT’s Head of Marketing and Communications Sydney Jones interviewed ARS Logica founder Tony White about the current trends in the CCMS/DITA marketplace. The interview tackles questions such as how COVID-19 has impacted the technical documentation industry, and exposes important considerations to take into account when selecting a CCMS. It also reveals some of Tony White’s key findings in his 2019 analysis of the CCMS industry.

Tony White has over 20 years of expertise in content management. In the past few years, his interactions with customers and manufacturers led him to start the Compass Guide as an answer to the increasing demand of information on CCMS, a system that was previously only in the realm of very technical sectors. The trends have evolved, and there is now increasing interest from marketers, who also happen to be decision makers.

So Tony, what inspired you to conduct this research on CCMSs?

The Compass Guide to Component Content Management Systems is a recent development. In fact, my background as content management analyst is for the most part in the unstructured content side of things. However, in the past few years, several reasons inspired me to start evaluating CCMSs:

The first reason was that the marketplace was starting to show interest for CCMS evaluations. Organizations would request CCMS platform comparisons, and research on the state of the market in order to decide what CCMS was best for them to orchestrate a smooth handoff of their structured content between their Digital Experience Platform (DXP) and a CCMS. No analyst firm was publishing this type of report then.

The demand also emerged from manufacturers of the technology, who were looking to point their prospects to research.

What decided me to move forward is that DXPs and CCMSs complement each other greatly. As they are going through the customer journey, customers are not aware of the handoff happening in the backend between structured and unstructured technology systems, which further demonstrates how well the systems function together.

In addition, while the CCMS technology used to be exclusively in the realm of technologists, it is becoming more relevant to non-technical business users. Organizations are more and more required to incorporate technical content, product information, and more detailed precisions in the customer experience they deliver.

Why in 2020 is it beneficial to choose a CCMS vs. a CMS?

The first differentiator for CCMSs is their level of DITA compliancy. DITA is an open structured standard used to manage, create, and publish content. DITA enables a CCMS to manage structured content more efficiently than a CMS, which is an unsatisfactory substitute.

An important thing to keep in mind is that many companies benefit from using both systems, so it is not necessary to choose one or the other.

The recent pandemic context has made it even more valuable to invest in a CCMS, as there has been an upsurge in reliance on digital as the sole point of customer interactions. Customers are less likely to call or visit businesses in person, and need to be able to access technical information through the digital experience. Companies where CMSs and CCMSs are well integrated have been put ahead of the others.

What is your process for evaluating a CCMS?

The process follows the framework of the sources of information that appear in the Compass Guide. It consists of using information that has been collected from several sources:

1.Vendor Questionnaire

The vendor completes an exhaustive questionnaire of about 200 questions relating to the company, its product, customers, verticals, history, wins and losses, revenue, etc.

The vendor questionnaire provides a reference point to go back to while producing the report and ensures the information is up to date.

2. Customer Interviews

Customers interviews aim at validating the responses provided to the vendor questionnaire.

3. Implementation Monitoring

In this step, I verify that vendors’ claims and information from the market are accurate. For instance, I look at whether the product roadmap issued to me the previous year has come into reality, and if features and functions that were listed in it are now available with the product.

4. Product Documentation

Product documentation provides in-depth details about the product. It is often included in the resources section of vendor websites and gives the final confirmation of what features/functions made it into a particular version of a product.

5. Ars Logica’s Knowledge Base

My 20-25 years of career in content management have allowed me to build up a broad and wide knowledge base, which is transcribed into the reports.

6. Hands-On Product Testing

Vendors often provide me with a sandbox to test the product. I use it to go through use cases from customers to see how a particular platform addresses certain requirements, and thus acquire experience in using the product.

Can you tell us more about the 2 axes you use to evaluate a CCMS?

I use a two-plot axis with respectively business criteria (plotted on x-axis), and technical criteria (plotted on y-axis). Under each of these, there are broad categories, which are combined into a single score:

Business criteria

- The Component Lifecycle Management refers to how the system manages the content lifecycle, from content creation to expiration. The average lifecycle lasts for 20 years. With CCMSs, the lifecycle is done at the component level, in CMSs it is done at the page or block level.

- Workflow and Approvals look at the complexity of how workflow is managed in several situations. For instance, if someone is on sick leave, or when the approval comes from individuals or groups, etc.

- Delivering a digital experience to customers involves a lot of collaboration, especially when organizations manage simultaneously technical and non-technical content. The collaboration and Information Governance’s category analyses how teams work together, and what sort of governance is put on the information for regulatory and for compliance.

- Localization and Translation Management addresses how content is delivered to different geographies and languages, whether there are translation partners, and if translation is automated, done by humans, or hybrid.

- Process Efficiency and Cost Containment is about how streamlined processes can be made, and how this contributes to containing costs. Cost containment and the possibility to measure it is very important in the consideration for people in the CCMS buyers’ market.

Technical Criteria

- Dynamic Delivery evaluates how content can be combined with other content to provide a unique user experience. It can be different content to the same user, or the same content to a wide variety of users. It is the ability to combine content on the fly based on any number of criteria.

- Taxonomy and Semantics deals with standards for describing content (metadata or other methods). The consistency of taxonomies is the fact of using the same word for the same purpose consistently and how metadata are managed.

- Scalability estimates if the back-end system scales can meet a spike in demand. Today, cloud is the standard answer to this. However, most implementations today are on premise, and the ability to scale is an important element to look at closely.

- Flexibility is the ability to integrate other enterprise applications. Systems vary dramatically in this sense. Sometimes connectors are pre-built for other enterprise applications, sometimes not. It is also critical to look at what can be accomplished with the API toolkit, and how easily.

- The Development Tools’ category looks at the API toolkit for developers. It is about how a platform makes a developer’s work easier by providing certain things out of the box.

The market is still behaving like an immature technology market, although it is about 25 years old. Because it has not reached a certain threshold from a monetary point of view, the larger technical systems integrators have not become interested in this as a coverage area they can provide services for. Therefore, the strength of the technical ecosystem, especially compared to DXPs, is low but important to look at. It is critical to check if a service provider is going to be able to do your implementation.

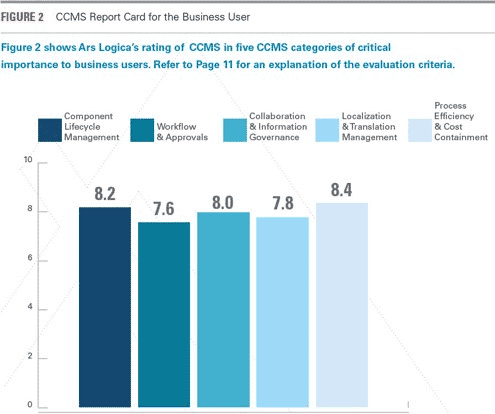

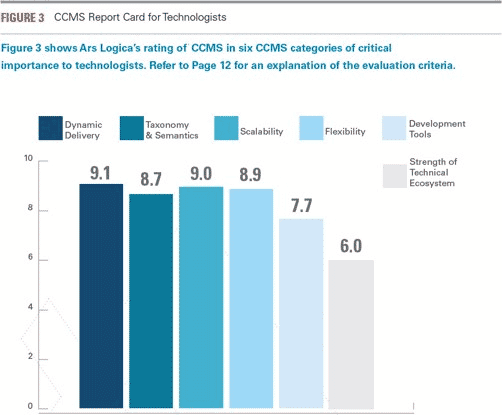

Let us look at a real-case example of business criteria, and technical criteria scoring with MadCap IXIA CCMS, extracted from the latest Compass Guide.

Business Criteria Scoring

Technical Criteria Scoring

MadCap IXIA CCMS performs consistently across the scoring criteria. This is in part because it has over 20 years of experience in the industry and is the first 100% DITA-compliant CCMS vendor.

It is quite rare for a vendor to have a 9 in two categories. I find that IXIA CCMS is an uncommonly capable technical platform from a historical and market perspective.

The technical ecosystem is lower than others. It relates to the size of the company. When compared to larger companies and vendors, the products do not perform as well, but the strength of their technical ecosystem is higher because they have larger partners and more of them.

How did you come up with these different categories to evaluate CCMSs?

I have received a lot of feedback from CCMS marketplace vendors and manufacturers about the need for these reports. The sources information I gathered, and these conversations gave me initial input as to what these categories should be. I then narrowed it to something manageable. It was important in this process to look at how features are related and who is going to use them to categorize them.

Can you comment on trends in the DITA CCMS marketplace?

Even though the CCMS technology has been around for 20+ years, it was first in the realm of highly technical users only. Consequently, CCMS platforms vary wildly in their feature function sets, and in the sophistication of the products.

In recent years, DITA has become more relevant to digital marketers in terms of the benefits it brings, and what it allows them to do in terms of content management. As a result, the ways that CCMSs are incorporating this feature set into the user interface is relevant to them. In addition, the ease of use of the DITA feature functionality is improving dramatically.

Finally, COVID-19 is forcing customer interactions to be digital. Companies that have well integrated DITA CCMSs and DXPs are responding better, and allowing for a better e-commerce experience.

Which industries are more likely to benefit from a CCMS?

Regulated industries are the ones that benefit the most from a CCMS. The more regulated, the more the benefits. Examples include manufacturing, aviation and aerospace, healthcare, financial services, and any industry that relies heavily on technical content.

An increasing number of industries now need to seamlessly combine technical and non-technical content as part of managing customer journeys that needs to include an increasing amount of content, and content types.

How has COVID-19 affected technical documentation as a whole? Or individual industries?

COVID-19 has forced the exclusive digital nature of interactions. As a result, technology is the unique way customers can get information from companies. If the information is structured such as SKU, product number, warranty, or else, the need of a CCMS is critical.

This puts a spotlight on the interaction between structured and unstructured content management systems.

What were some of your conclusions based on the evaluation of IXIA CCMS?

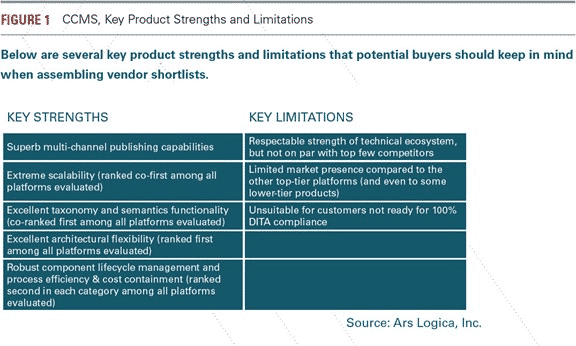

Let us first look at IXIA CCMS’ key strengths:

- IXIA CCMS offers extensive multi-channel publishing capabilities.

- The platform is also one of the few vendors ranking in the leader category, and provides extreme scalability to efficiently handle large implementations and spikes in demand.

- IXIA CCMS is also 100% DITA-compliant, which results in excellent taxonomy and semantics functionality.

- The platform architecture is organized in a subtle way, and is highly flexible.

- The ability to manage content from cradle to grave is robust.

IXIASOFT ranks first or co-first in many of these categories.

Looking into the limitations, IXIA CCMS has a very strong technical ecosystem, although it is not large compared to some competitors. This relates to its limited market presence compared to the other top-tier platforms, which are bigger companies. Finally, IXIA CCMS might not be a right fit for companies who are not 100% DITA-compliant, or do not have a project to become so shortly.

What are some requirements of customers for whom IXIA CCMS might be a best fit?

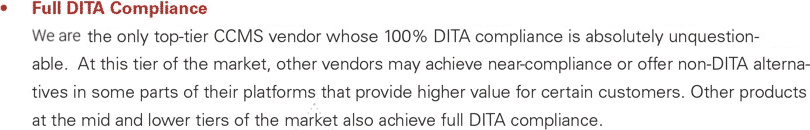

Full DITA compliance would be the first criteria:

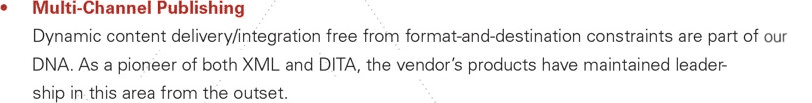

Number two is multi-channel publishing, which is simultaneously a strength, and requirement. Dynamic content delivery relies on content being format free so that the destination is not constrained.

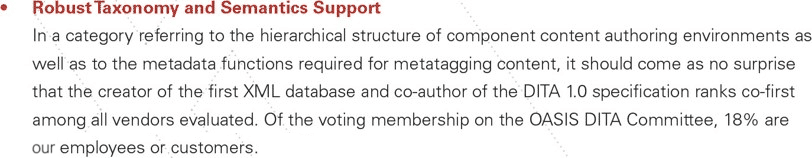

The third one is robust taxonomy and semantics support.

To download the full report, click here.

What does the future of the CCMS marketplace look like?

First, the integration of structured and unstructured content solutions will improve. This will be an initiative from the vendors themselves, through more partnerships between structured and unstructured vendors. Companies that have traditionally offered web CMSs will increasingly offer CCMSs. Furthermore, as implementation providers witness the growing synergy between structured and unstructured platforms, they will start offering specialized services.

Then, I foresee that companies that are producing the most sophisticated platforms will be doing so at a brisker pace than companies that have developed simpler platforms, which will continue widening the gap in sophistication between the top-tier platforms and the rest of the market.

Finally, the large system integrators that were not interested in this technology in the past will grow interest for it, as it crosses a certain revenue threshold. This will provide an improved partner landscape.

Can you predict any future trends with DITA or CCMSs?

I have already started to see the first one come true, which is that artificial intelligence and machine learning are starting to play a major role in vendor roadmaps, especially in the area of predicting customers behavior and providing the right customer journey based on it.

This trend combined to DITA will finally make a wide variety of “self-service” attempts successful.

CCMS vendors will also start to differentiate within particular verticals over the next 18-24 months by offering specialized services by industry, such as financial services or semiconductor.

Lastly, digital marketers will not only become the primary buyers of CCMS, but they will also be the primary drivers of the CCMS market evolution.

—

Thank you to Tony White for sharing his findings and comments on the present and future of the CCMS/DITA landscape, and tips on how to choose the right CCMS. The full Compass Guide to Component Content Management Systems is available here.

This blog was originally presented as a IXIAtalks webinar with Tony White from ARS Logica. You can find the webinar here.

Learn more about our IXIAtalks webinar series.